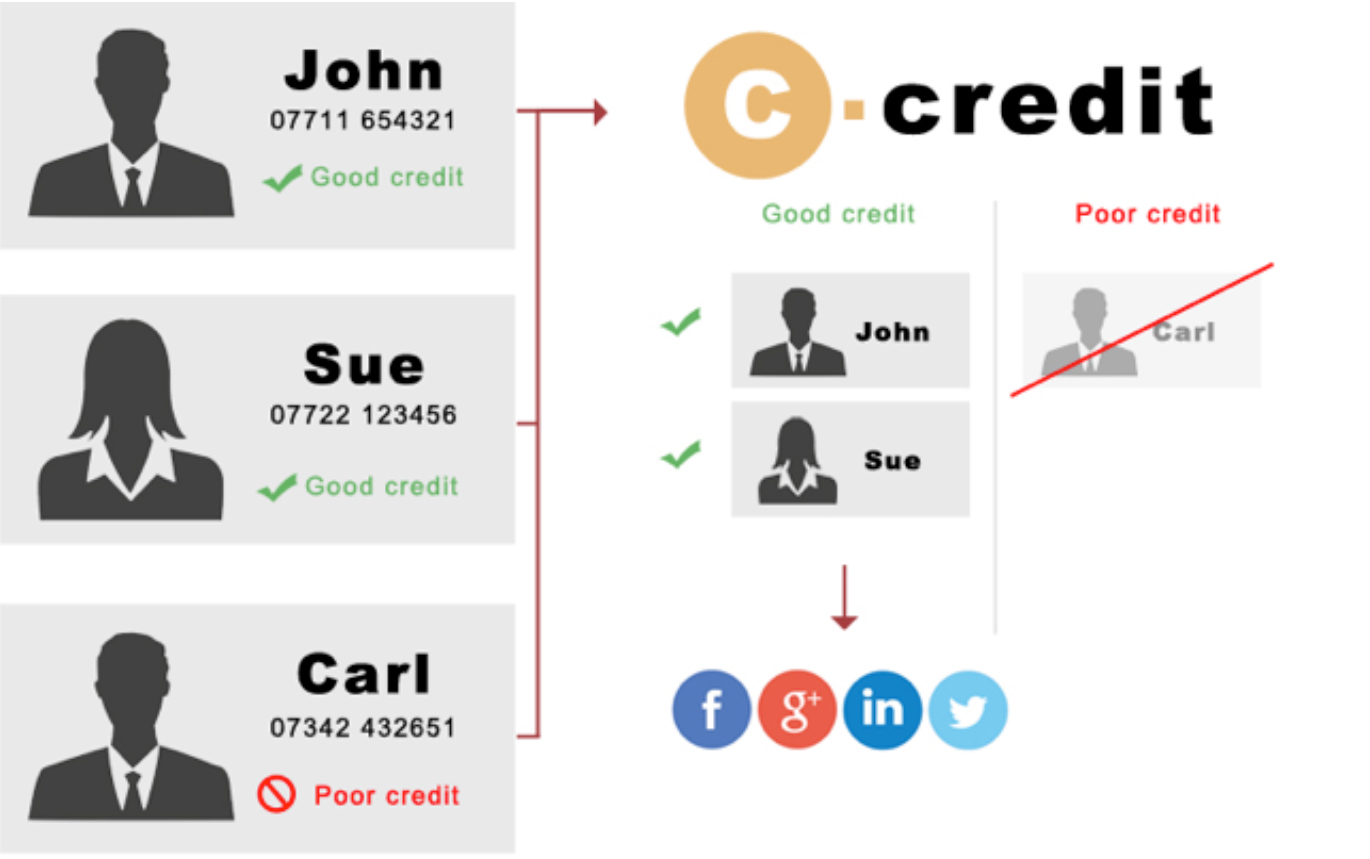

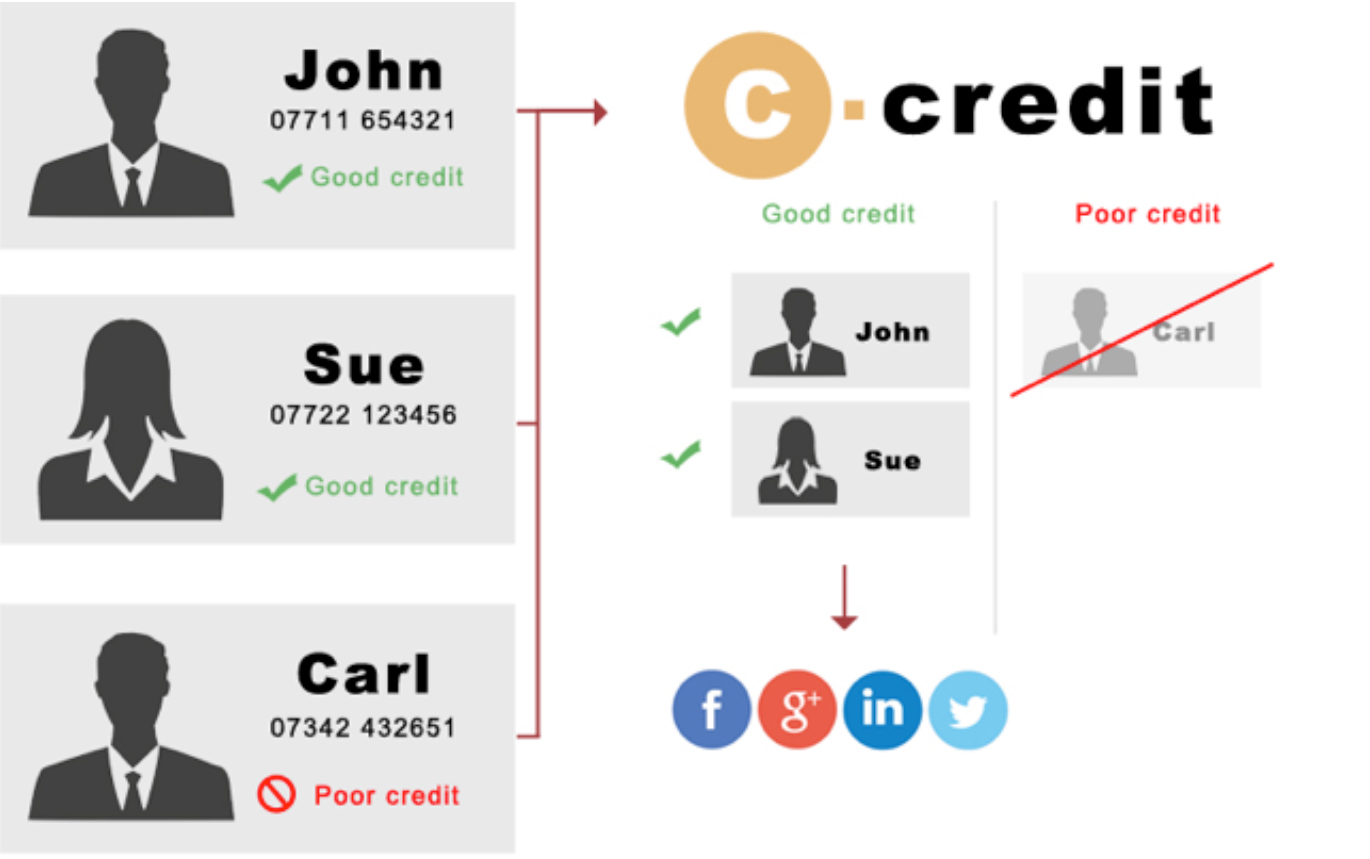

Pre-screen custom audiences against negative credit data and exclude high risk prospects.

Pre-screen custom audiences against negative credit data and exclude high risk prospects.

We developed c-Credit to meet the needs of clients who rely on credit based finance for their products or services. Advertising to potential customers who do not meet the necessary credit profile requirements is a waste of your media spend and causes an unnecessary stress for the prospect.

Using c-Credit your data can be matched against our dataset that that has credit scored all UK households based on our partnership with Equifax, one of the leading credit reference bureaus. You can then suppress before matching

to Facebook custom audiences, meaning only those records which meet certain criteria will end up seeing your ads. Additionally, if you are using Facebook custom audiences to generate “lookalike” audiences for your ad campaigns, with c-Credit you can segment your customer data into those prospects likely to have the best credit scores before you create a lookalike audience, meaning the output of that audience is statistically likely to include more people with favourable credit profiles.

If your business relies on consumer credit then advertising to prospects who are likely not pass a credit check wastes valuable ad budget and inbound contact centre resources.

Via our integration with the UK’s largest consumer credit agency we extract the prospects from your marketing databases who are most likely to be approved for credit, before you advertise to them.

Using a credit profiled UK household universe.

Stop wasting ad spend and call centre resources on prospects who cannot convert into customers. Focus your spend on customers who you know are highly likely to be approved for credit. Or tailor your advertising based on a prospects likely credit rating.

No other data provider can offer this level of credit suppression of advertising audience data. Other partner category data inside Facebook ads typically uses sampling and modelling and isn’t accurate when trying to target individual customer records based on their credit risk.

A UK mobile phone provider wants to target its “Pay As You Go” customers with a migration offer, moving them to monthly contracts. But the client knows that a large proportion of the customer database use PAYG because their credit risk means they won’t be approved for a contract phone.

Advertising the upgrade offer to these individuals isn’t in the interests of the client, or of their customers.

Running the PAYG customer database through c-Credit we can output a cleansed target list for use as customer audiences in the clients Facebook Ad campaign. Using a negative audience list the client can use the same data in their Google AdWords campaigns to make sure that those customers who don’t pass the credit risk check will not see and click on Google Ad’s promoting the offer.